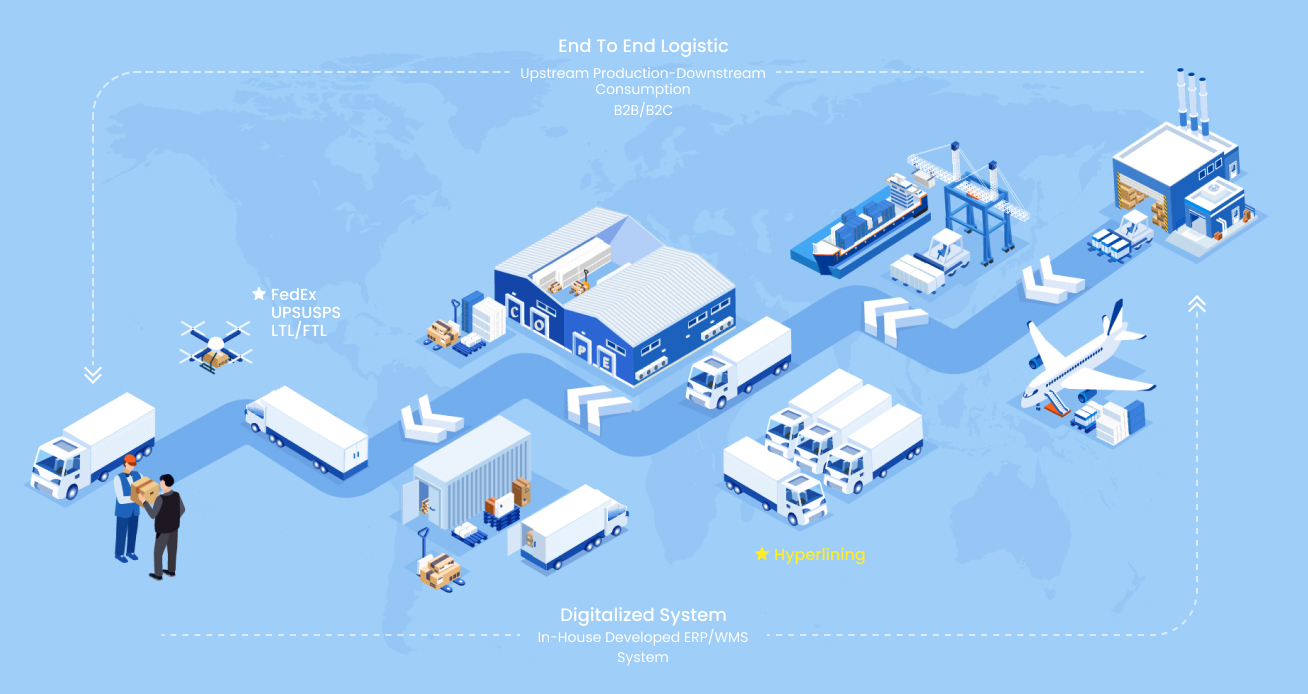

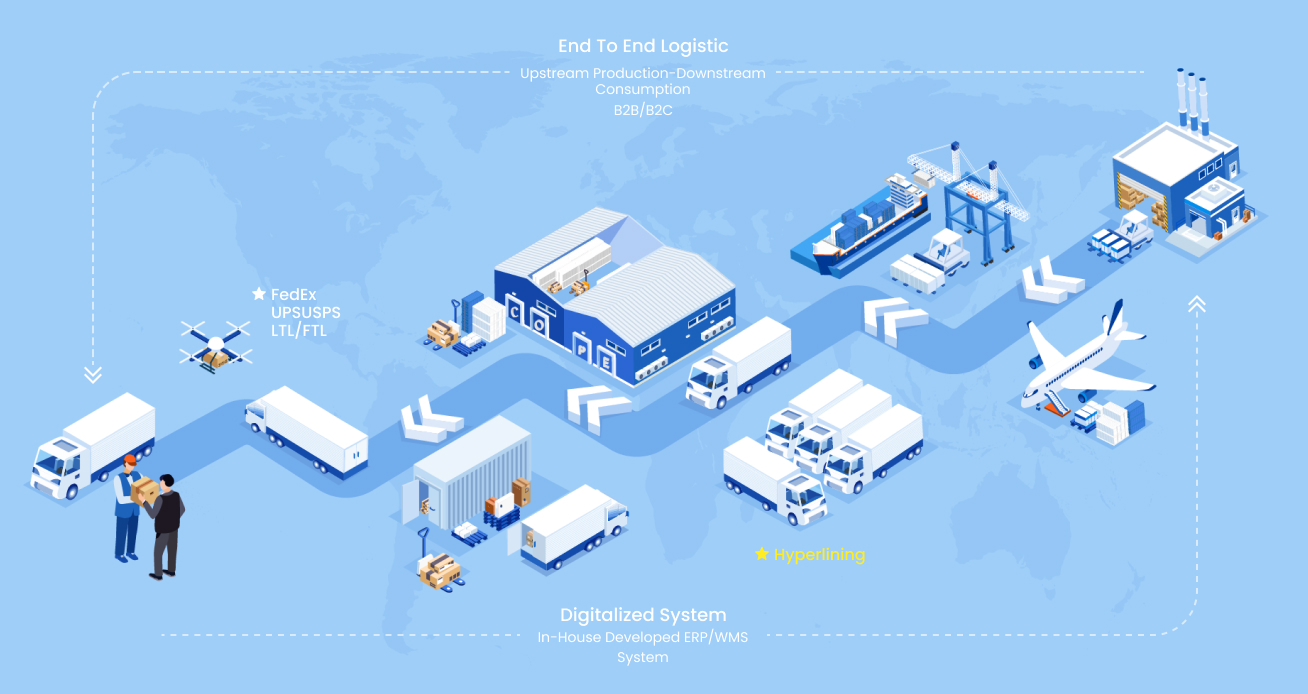

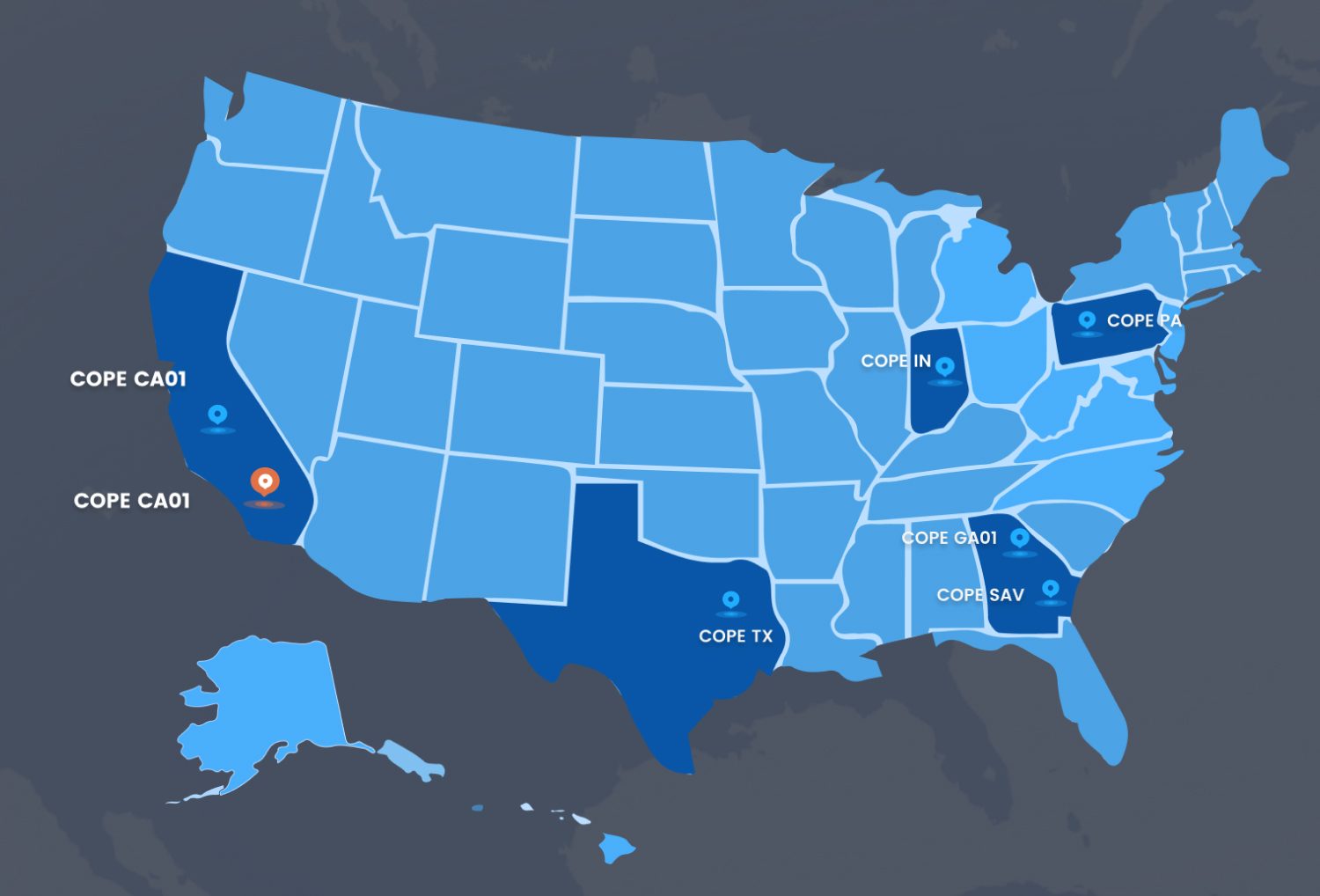

A professional fulfillment center tailored to meet the current needs of e-commerce

Seamless online order fulfillment, offline store replenishment, and distribution solutions

Continuously focusing on medium and large-sized products while optimizing last-mile delivery resources

Delivering customized services tailored to customer needs, improving efficiency, reducing costs, and ensuring quality.

By implementing streamlined management, proprietary systems, and KPI tracking, we significantly improve efficiency and accuracy